Trusts are versatile legal arrangements that offer individuals and families a wide range of options for managing their assets, protecting their wealth, and achieving specific objectives. Understanding what is a trust and the different types of trusts are essential when considering estate planning, wealth preservation, charitable endeavours, or business succession. In this article, we delve into what are trusts and the various types of trusts, highlighting their unique characteristics and purposes. Trusts can be categorised into various types, although their names may differ depending on the jurisdiction.

WHAT IS A TRUST?

A trust is a legal arrangement in which a person, known as the settlor or grantor, transfers their assets (such as money, property, or investments) to a separate entity called a trustee. The trustee holds and manages these assets for the benefit of one or more individuals or organisations known as beneficiaries. The terms and conditions of the trust, including how the assets are managed and distributed, are typically outlined in a legal document called the trust deed or agreement.

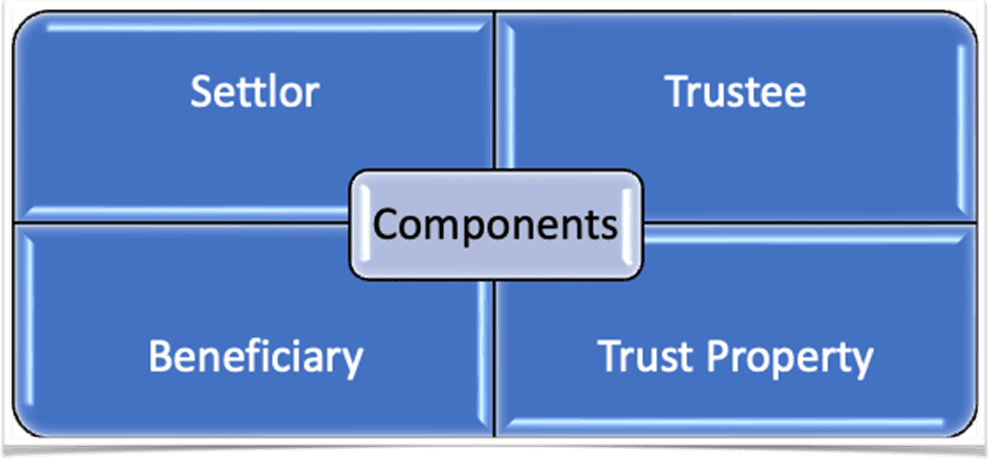

WHAT ARE THE MAIN COMPONENTS OF A TRUST?

Settlor/Grantor

The person who creates the trust and transfers their assets into it. The settlor establishes the terms and objectives of the trust.

Trustee

The individual or entity responsible for managing and safeguarding the trust’s assets. The trustee has a fiduciary duty to act in the best interests of the beneficiaries and to follow the instructions outlined in the trust document.

Beneficiary

The person or organisation that benefits from the assets held in the trust. Beneficiaries can receive income generated by the trust’s assets or have access to the assets themselves, depending on the terms of the trust.

Trust Property

The assets or property transferred by the settlor into the trust. This can include cash, real estate, investments, businesses, or any other valuable assets.

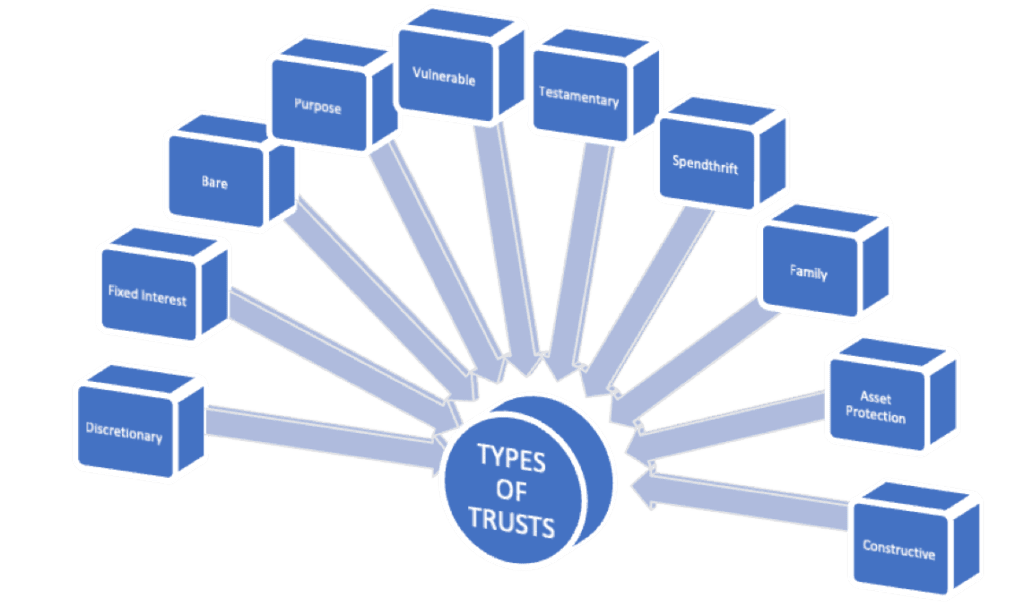

WHAT ARE VARIOUS TYPES OF TRUSTS?

1. DISCRETIONARY TRUSTS

In a discretionary trust, trustees have the authority to distribute capital and income to a designated class of potential beneficiaries. The trustees have complete discretion in deciding how and when to distribute the trust’s assets, and they can even choose not to distribute anything for a period of time.

2. Fixed Interest Trusts (or Interest in Possession Trusts)

A fixed interest trust grants the income or benefit from the trust to a specific beneficiary, who has a legally enforceable right to it. The entitlement may be shared among multiple beneficiaries, but each has a fixed and predetermined entitlement.

3. Bare Trusts

A bare trust is a simple and inflexible structure where the beneficiary has an immediate and absolute right to both the income and assets of the trust. The beneficiary’s rights are fixed from the outset, and upon reaching a specified age, they gain complete control over the trust assets.

4. Purpose Trusts

Purpose trusts are established to hold assets for a specific purpose. Charitable trusts, which distribute assets for charitable purposes, are the most common type of purpose trust. In some jurisdictions, purpose trusts can also be created for maintaining graves or fulfilling other legally permissible objectives.

5. Trusts for the Vulnerable

Trusts can be tailored to benefit individuals classified as vulnerable due to disabilities or mental health conditions. In some jurisdictions, these trusts come with special tax treatment, ensuring that the vulnerable beneficiaries receive discounted tax benefits.

6. Testamentary Trust

A testamentary trust is created through a will and takes effect upon the testator’s death. It allows individuals to specify how their assets will be distributed to beneficiaries, especially when beneficiaries are minors or require specific conditions for asset management. Testamentary trusts offer control and flexibility over asset distribution while ensuring the beneficiaries’ best interests are protected.

7. Spendthrift Trust

This trust is designed to protect beneficiaries from their own poor financial decisions or potential creditors. This trust type restricts the beneficiary’s access to the trust’s principal, providing periodic distributions instead. By sheltering the assets from creditors, spendthrift trusts ensure the long-term financial security of the beneficiaries.

8. Family Trust

Family trusts are created to benefit family members, providing asset protection, estate planning benefits, and potential tax advantages. These trusts allow for the transfer of wealth between generations while providing flexibility in asset management and distribution.

9. Asset Protection Trust

Asset protection trusts are designed to shield assets from potential creditors and legal claims. These trusts are typically established in jurisdictions with favourable asset protection laws. By transferring assets to an asset protection trust, individuals can protect their wealth while retaining certain control or beneficial rights over the trust’s assets.

10. Constructive Trust

A constructive trust is created by a court order to remedy a legal or equitable issue. These trusts are imposed to prevent unjust enrichment or enforce specific obligations. Constructive trusts can arise in cases of breach of fiduciary duty, fraud, or other situations where it is necessary to place assets in a trust to rectify the matter.

Conclusion

Trusts offer valuable advantages in asset management, estate planning, and philanthropy. By understanding the different types of trusts available, individuals and families can select the most appropriate structure for their specific objectives. Whether it is protecting assets, planning for succession, providing for loved ones with special needs, or supporting charitable causes, trusts provide a flexible and powerful legal mechanism to achieve these goals. Consulting with legal and financial professionals is highly recommended to ensure the proper establishment and administration of trusts based on individual circumstances and local laws and regulations.